New Financial Literacy Curriculum

The province of Ontario has announced an update to the out-dated (2005) Math curriculum for elementary schools that will include the topic of financial literacy:

"In the 2005 curriculum, financial literacy concepts are limited to basic understanding of money and coins. In the 2020 curriculum, there will be mandatory financial literacy learning in grades 1 to 8, including understanding the value and use of money over time, how to manage financial well-being and the value of budgeting".

Sorry to all of the graduating grade 8's of 2020, but perhaps a few lessons for you to enjoy through the summer months (Ya right!) and perhaps for Premier Doug and Minister Lecce a primer of a few key elements:

Lesson 1) Banks (and other large financial institutions) : They are safe (for the most part) and highly regulated so as to give you the appearance of safety and stability. They are also public companies and therefore have shareholders who are their first priority. I worked for a number of banks and large financial institutions throughout my career. I know what motivates them: earnings and profits. This is not a bad thing, necessarily depending on your perspective, but if you are to utilize a bank as a client there are a few things that you should know.

If you put your money in a savings account or GIC, the bank will pay you interest of between 0% and maybe 1%. Then they will take that money and lend it at somewhere between 3% and 5% (or more) to those in need of capital for whatever purposes. A lot of that lending goes to homeowners for their mortgages and lines of credit. If you have savings and a mortgage with the same bank, you are giving them "free" money which they will gladly and quietly accept, making for their shareholders a quick 3-5% (simple math for the new curriculum) on it. They win. Clients lose. So Don't be that kind of client.

In fact, if you are saving money or investing it and not making more than what the borrowing costs of your mortgage are, pay down your mortgage (or line of credit).

Lesson 2) Credit Cards : Never, never, never carry a credit card balance from one month to another. The interest payments at 18% or more (that is enormous when you think about what a bank savings account pays!) will never allow you to get out of debt, because you will build massive negative compounding (see positive compounding below and think the opposite) issues that will haunt you until forever! If you can't pay it off. Cut it up. Am I clear? Shareholders win big on this one. Opposite for the clients.

Lesson 3) Compounding :

Simple math: if you invest $100 at the beginning of the year and you earn 4%, ($100 x 4% = $4) at the end of the year you will have $104. At the end of year 2 ($104 x 4% = $108.16), etc. In 10 years (invested at 4%) that $100 will turn into $148.02.

If you were able to scrounge up an additional $10 to add to the investment each year for 10 years (invested at 4%). The total jumps to $272.89.

If you change the return to 7% annually (adding the $10 each year), your total jumps again to $344.55.

If you can add some 0's to your amounts (i.e. $100 becomes $1000 or $10,000), you can imagine the upside!

Go get an excel spreadsheet, go to the "Formulas" tab, then to the "Financial" tab, type in FV and play with the numbers. Amazing what seeing the potential can do to stimulate you.

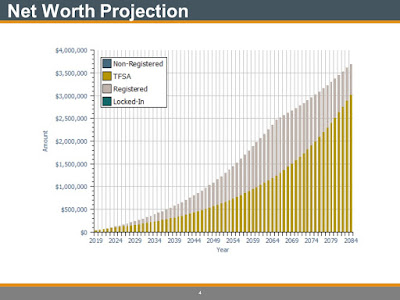

One day it might look like this (an actual 20-something year old's High Rock Wealth Forecast):

Lesson 4) Budgeting : Create a plan (or Wealth Forecast) that allows you to save something. Start with $10, move on to $100 when you can and keep building. Don't starve yourself, enjoy yourself too, but make an allowance to pay yourself. Income (or allowance) - expenses = savings.

Lesson 5) Investing : Everybody wants to "help" you invest. Some will tell you they can get you 7%, no problem. They have an agenda, so beware of the agenda. Ask them what is in it for them. Anything but an absolutely direct answer should be a red flag. Walk immediately away. You see, every financial advisor has a conflict of interest, it is called commissions (how they are paid). They want to "help" you so that they can take a piece of your 4% or 7%. In some cases, good help may be worth a 1% fee, but beware of how the costs of investing impact your compounding.

And always know that past performance does not guarantee future returns (even though some might not be so upfront as to tell you so)!

Mandatory reading: Beat The Bank , by Larry Bates and Standup To The Financial Services Industry by John De Goey.

Lesson 6) Risk : If inflation / the cost of living (your annual expenses) is 2% per year and you invest "risk free", lending money to the Government of Canada by purchasing a 90-day T-bill, that will earn you 0.19% before fees and taxes. So you basically won't be able to make your money grow and your purchasing power (i.e your costs increase faster than your money is growing) will erode. So you want to get better than 2% in your returns.

Getting that will entail a bit of risk taking. You can buy the common shares / stocks of companies that you expect will grow enough to see the value of those companies go higher and increase their share value, but you need to be able to judge those companies and the fair value of their stock. Owning just one company will add significant risk (of the companies value going down). Owning lots of companies helps you to diversify and reduce the risk. Unless there is a major catastrophe when all companies values fall. Usually, the better companies can survive a catastrophe, but it is never certain which ones. So if you own a whole bunch of companies, you can ride out the catastrophe because, most will likely survive it. If you are young, time is on your side, so you can afford to take a little more risk (go for the 7% returns, perhaps?).

If you are a little older and /or need more cash flow to augment your lifestyle expenses , you may want to look at alternatives that will provide interest and dividend income (see last weeks blog) and further balance out your portfolio and reduce your risk (go for the 4% returns, perhaps?).

Lesson 7) Taxes: Especially now! Governments want their fair share for providing all the services (and bail-outs in times of crisis) and they are going to try to take it from you. It is inevitable and after the pandemic and it's associated costs, taxes are not going down. But be mindful of how you might best manage to be as efficient as you can as you invest. Maximize the use of your TFSA, that should be priority number 1.

There is more and as you get more wealthy (positive compounding), it gets more complex. Some try to do it on their own, if you can, you can certainly reduce your costs. However the professionals (good portfolio managers and Certified Financial Planners who know their stuff) should be able to add value and be responsible to you to do their very best to look out for your best interests (rather than be driven by commissions, a huge conflict of interest).

Avoid "day trading", the lure of big gains can come with enormous risk. History (not necessarily part of the math curriculum) has shown this time and again.

You don't have to "get rich quick". Make a plan, stick to the plan and compounding over time will bring you the benefits!

No comments:

Post a Comment