Big Drop In Stock Market And Uptick In Volatility. Should You Be Worried?

Absolutely you should be worried. Especially if you are over-weight equities in your portfolio. See that gap between the most recent drop (today) and yesterday? If that gap remains (i.e. the Dow Jones Industrial Average is unable to see buying enough to drive it to fill the gap any time soon), then stocks are headed lower. That means that longer term stock owners will be looking for selling (profit-taking) opportunities. We have been telling anyone who will listen that we have thought and continue to think that stocks are expensive on a number of metrics (see our most recent Weekly High Rock Video).

The selling pressure is coming from simple re-balancing of portfolios. If you have continued to be long equity assets through the run-up in prices, then you have automatically become over-weight.

Big money managers who do monthly re-balancing are turning into big sellers because they have become over-weight, simply on the increase in prices.

I just saw, on a business channel, the head of a wealth management operation of a bank tell us viewers not to worry.

Well, I would suggest that would depend on whether your portfolio has been properly re-balanced or not.

We run a report weekly to stay on top of how balanced our client portfolios are (part of the being nimble that is a benefit of working with a small money manager) relative to the allocation targets in their Investment Policy statement.

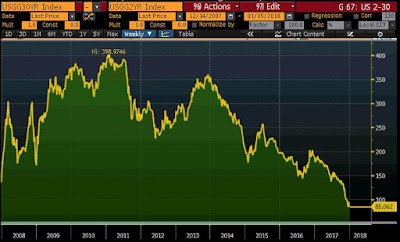

Is volatility making a comeback?

Probably too soon to tell. It depends on what kind of follow-through selling or buying materializes over the next few trading days. Normally after a period of below average volatility, there is eventually a spike higher. Lately, those spikes have not seen much follow-through.

So you need to ask yourselves: how much do I value my sleep? If today's price action worries you, then you best get a handle on your portfolio balance or re-balance.

One thing I know is that our High Rock Private Clients do not need to lose sleep.