Still Plenty To Give Thanks For

One of my favourite holidays from when we resided in New York was Thanksgiving (we call it U.S. Thanksgiving because we still celebrate both the Canadian and U.S. holidays), there was always such a good feeling that surrounded it, the air was crisp and cool and there seemed to be a spirit of goodwill in the air: it started with the evening before which usually involved a skate at Wolman rink in central park:

And the blowing up of the floats that begin later in the evening in preparation for the Macy's parade and took most of the night on W81st street where we were the guests of the Excelsior Hotel for the night (our home at the time was on the north shore of Long Island, Baxter House, Port Washington). A few seconds walk to my aunt, uncle and cousins' place at the corner of W81st and Central Park West, across from the Museum of Natural History, where there was always a Thanksgiving Eve party or get together that followed our Wolman skate.

We (my daughters were 4, 6 and 8 for our first parade in 1993) were early to rise in the morning and the excitement was palpable as we wandered, pre-parade, about the newly inflated characters (usually, as I recall, Spiderman and Clifford, the Big Red Dog, among others) just outside the hotel door. The kids were in awe, which added to the spirit of it all. Fantastic memories:

We won't be in NYC this year, as we were last year. As with a lot of our annual traditions, this one has been put on hold (who knows what lies in store for us at Christmas time), however, apparently, the parade will go on for TV viewers, but in a different format (but still in NYC) thanks to Covid-19. Out of nostalgia, I will be tuning in.

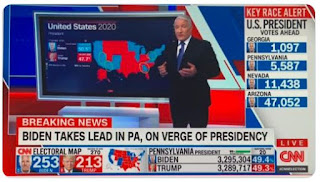

Despite all the upheaval brought on by the coronavirus pandemic, there is plenty to give thanks for: what looked like an economic and stock market meltdown back in March has turned itself around considerably thanks to government and central bank policy stimulus, followed by what may possibly be some political directional change and vaccines that, at the moment, look to have a pretty high level of efficacy.

Yesterday, a pair of our younger clients put an offer in on their first home and needed some cash, so we were busy locking in what looks like a fine return (after fees) year to date, in a pretty balanced mandate (a little more aggressive for them, given their time horizon of 40 or so years to retirement). Nonetheless, back in March, I don't think many of us would have seen that happening.

This pandemic is far from over and it is possible and even more likely that the realities of job losses for many are going to catch up with the economy before the vaccines are able to allow for a better future, but there is certainly some encouragement for that future.

Stocks hit record highs on the back of this encouragement (and I love selling into record highs and taking profits), but as I mentioned last week, valuations are stretched and the "fear and greed" index is suggesting that we are looking at "extreme" greed at the moment. Usually this is followed by some effort by stock markets to correct and buying opportunities will abound when that happens.

So we can be thankful, but we should not be complacent.

As well, remember that past performance is not a guarantee of future returns and while, at High Rock, we work darn hard to get the best possible risk-adjusted returns for our clients, many clients may have different goals, objectives, risk tolerance and time horizon's and all of this goes into the building of a tailored and personalized investment strategy.