Smoke And Mirrors: This Time It's Different?

From yesterdays Globe and Mail: "After a long slumber, Canadian retail investors are back as a powerful force, in fact the online systems they trade through can't seem to handle the volume."

OK folks, that is the latest warning signal, accompanied by "new record" stock prices:

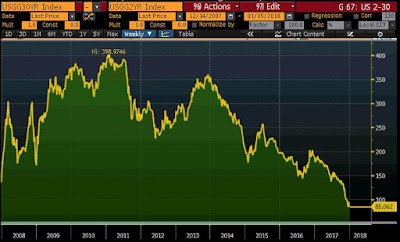

Investors are "all in" (you may need to click on the chart above to enlarge it), or at least almost "all in".

One thing is for certain, all of the good news is baked in to current prices, further stretching valuations. With analysts anticipating a 13.1% rate of earnings growth for 2018, the 12 month, forward looking Price to Earnings ratio (18.4 times) for the S&P 500 is almost 30% above its 10 year average (14.2 times).

Remember reversion to the mean ?

US tax reform and deregulation excitement, bitcoin euphoria and "high" marijuana stock trading volumes are perhaps over-shadowing the reality of higher interest rates on the horizon (with household debt at record levels).

All previous economic downturns have come on the heels of rising short-term interest rates that flatten the yield curve (the difference between 2 year and 30 year bond yields) to zero.

In Canada that differential has narrowed to 0.58% from over 1.50% at the beginning of 2017.

In the US, to 0.85% from over 2.00% at the beginning of 2017:

One more 1/4% increase in Canadian short-term interest rates by the Bank of Canada should just about push us in that direction (despite recent decreases in unemployment).

The anticipated two or three 1/4% increases by the US Federal Reserve should just about do it for the US.

Remember also that all previous recessions in the US have followed closely on the heels of an upturn in the US unemployment rate that intersects and crosses through the 3 year moving average:

At the moment the differential is 0.7.

Is it different this time?

Many will find technical rationalization (smoke and mirrors, I think) to say that it is. Many of them, the so-called experts are heavily invested in stocks right now and really want to see retail investors buying into the hype so that they can unload their investments at these record prices. Of course, that's what the "smart" money was doing last time (when it was also different).

As I say over and over again, risks are high and rising and at High Rock, we are taking this into consideration. Are you?

No comments:

Post a Comment