Want To Compare Your Net Worth With The Canadian Averages?

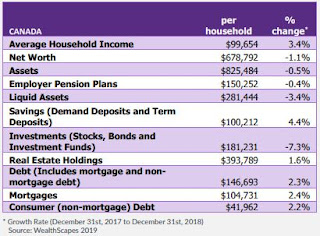

Environics Analytics, the Toronto-based marketing and analytical services company, produced their WealthScapes report that "explores the financial well-being of Canadian households". This particular report shows the data for calendar year 2018, so it is a little dated, but if you want to make some general comparisons to how you are progressing, relative to the rest of the country, it makes for an interesting snapshot, especially the year to year % change, from 2017.

Notably, household incomes rose 3.4%, while total net worth declined by 1.1%. Investments fell 7.3%.

It absolutely amazes me that "Savings" in demand (chequing / savings accounts) and term deposits (GIC's) = $100,212, which is 12% of total assets. Not only that, demand deposit rates at banks are basically 0%, so you get almost no return on your money in those vehicles, but household debt is $146,693, where you are likely paying 3% or more to the same institution that holds your savings. Go figure? Pay down your debt with what is in your chequing / savings account, save 3%. Why give the banks and deposit taking / lending institutions free money? Crazy folks us "average" Canadians (whoever we are).

Or invest it (with discipline) and avoid the costly mutual fund industry who will try to take close to 2% of it.

There are plenty of ways to save a per cent here and a per cent there, so you best get a plan and investing strategy together to help you maximize your efficiencies. That is what we do at High Rock. We are not conflicted. Can you imagine that the bank wants their advisors telling you to use the free money that you give them in chequing and savings accounts to pay down their mortgages where they can make 3-5 % from you? No way! That is where they make their big money.

A per cent here and a per cent there adds up over time and can have a very large impact on your net worth in a twenty to forty year period.

A plan (or Wealth Forecast, as we call it at High Rock) will assist you in getting ahead of the "average" by ensuring that your money is working at maximum efficiency at all times. That is the key to financial success above and beyond the "average" Canadians.

No comments:

Post a Comment