Non-discretionary Financial Advice: It Could Leave You Hanging Out To Dry

Only 3% of advice givers in the financial services industry in Canada have fiduciary duty (client first at all times / no conflict of interest) because they have the legal responsibility of being discretionary portfolio managers (see the Small Investor Protection Association report: Advisor Title Trickery).

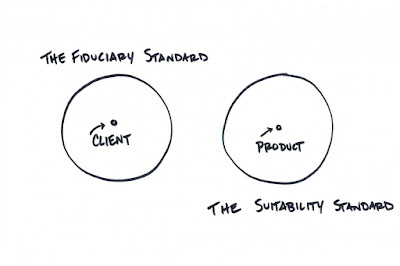

That means that most advisors (in the 97%) only have the responsibility to make sure that when she / he puts a client into an investment or set of investments (portfolio), he / she only has to ensure that at that moment in time, they are suitable for that client (objectives, risk tolerance, time horizon).

If, at some point in the future, circumstances change: the investment is no longer suitable for the client or the client is no longer suitable for the investment, that is no longer the advisors legal responsibility, in fact it is left to the client to make that decision (or to take the initiative to ask the difficult question). Really.

So, in fact, recommending that the client move out of that unsuitable investment is not an obligation for 97% of advisors.

How comfortable does that make you feel?

How comfortable does that make you feel?

In a nutshell that is the difference between non-discretionary advice and discretionary portfolio management. A discretionary portfolio manager (like High Rock) has a legal fiduciary responsibility to her / his client.

So the 97% continue to seek commission revenue, but are not required (legally) to provide anything beyond that initial sale (fee-based or transaction oriented).

It is not the first time I have written about this and likely won't be the last, because, basically it is not fair to the unsuspecting client who's portfolio drops significantly and not until sometime well down the road do they realize that the person they thought was looking out for their best interests is nowhere to be found.

Have you ever heard the line in a portfolio strategy meeting: "if things get ugly, we will get you out"? A non-discretionary advisor won't have the time to get you out (because she / he has to call you first). In a big (non-discretionary) advisory practice how many calls will be made in time?

If you don't want to hear about this from me anymore, just please let me know, directly, I won't be offended (well maybe just a little, but I will get over it).

I don't write this stuff for any other reason than that I care and that I think there are so many vulnerable wealth management clients out there who's advisors are not in it for the client, but rather for their own monetary gain.

It is one of the main reasons that we started the High Rock Private Client Division in the first place: to be different and better. And we are: recognized by the Small Investor Protection Association (SIPA) in their June newsletter as a "new breed".

It is one of the main reasons that we started the High Rock Private Client Division in the first place: to be different and better. And we are: recognized by the Small Investor Protection Association (SIPA) in their June newsletter as a "new breed".

1 comment:

This year our investment profit growth is a hundred forty five. we've got earned over Rs. 6,100 profit on sale from equity.

Equity Cash Tips

Stock Market Advisory

Post a Comment