5 Months Into The Year

Let's have a peek at what has been happening with the components of the 60/40 model:

(60% Equity / 40% Fixed Income)

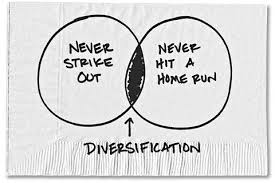

Remember that the idea behind the 60/40 model is balance and diversification over long periods (multiple years). The different asset classes that are represented will have periods of out-performance and under performance over this time, but the mix is intended to drive down volatility and provide target annual average returns of between 7 and 8% over a multiple year time horizon.

(click on the chart to enlarge)

Returns are before fees and tax considerations and are based on a broad mix of ETF's with consistent weightings back tested over 11 years, re-balanced quarterly (inclusive of the period 2008-2009), however historical returns are not a guarantee of future returns.

Best performing assets (total return) this year to date (since Jan.1):

- International Large Cap (Companies) = up close to 17%

- Emerging Markets (lead by China) = up close to 14.5%

- International Small Cap = Up close to 14%

Other notable performances:

- Positions held in US $ (converted back to C$) have added an additional 7%

- Canadian Small Cap and US Mid Cap companies indexes are up over 5%

"Under" performers:

- Canadian Preferred Shares = down by approx 5%

- Canadian High Yield bonds = flat

In reference to the theme that different assets out-perform and under-perform at different times (and justification for sticking with this model over long periods):

last year at this time, the best performers were:

- Canadian Inflation Indexed Bonds

- Canadian Large and Small Cap Companies

- Canadian REIT's

- Canadian Preferred Shares

Under-performers:

- US Small Cap Companies

- International Large Cap Companies

What is a highly important process in this type of model is the on-going re-balancing which trims (sells) the out-performing assets back to their original weighting and redistributes the cash by buying the under-performing assets which are underweight.

This is on-going profit-taking and using the proceeds to pick up under-valued assets.

For example if you trimmed Canadian Preferred Shares (last years out-performer) and picked up International Large Cap Companies (this years out-performer) you have added significant value.

The Takeaway:

Balance, Diversification and Re-balancing are the keys to successful investing over a multiple year time horizon.