Why I Love My Job (Flattening The Curve)

But first, Happy Canada Day friends! We live in a great country. Not perfect, by any means (a bit chilly in the winter for us older folks, perhaps), but given the current situation, I can't think of any place that I would rather be living.

But that is not what my blog is about today.

I get excited when our younger clients take an interest in investing. In this particular case, a 20-something year old who's grandparents were clients as well as his aunts and uncles, with a relatively small portfolio, but a great starting point from which to get building.

"Hello Scott, I finally worked up the courage to start

building my own portfolio. So far I’ve identified BMO, Manulife and Suncor as a

good place to start if I can get them at the right price. However my reasoning

does relate back to the fact that BMO and Manulife both pay dividends.

Originally I was looking to hold a GIC, however I think holding the above

stocks might see a long term value change if things go my way as well as some

dividend cash in the mean time. I was wondering if you have any idea whether either

would be looking to cut their dividends due to this covid situation. All the

best and hope you are staying safe."

My response:

We are all well here, hunkered down, but less so as the

province and GTA open up. Hoping you and all your family are well!

Congratulations on taking a big step forward and thinking

about your investment portfolio. There is a lot to consider. As I am uncertain

as to how much investment management education you might have, I am going to

offer up a few things to consider, but at any time, I am wide open to a much

more detailed conversation with you, at your convenience.

1) What are your goals? What is it that you want to

accomplish with your money? Obviously you want it to grow, but it is important

to establish what you want to grow it to do for you and the timeline for doing so.

Condo or house purchase, retirement, etc., I find it helpful to think in terms

of where you want to be in 3, 5, 10, 20 year time frames.

2) We all have to take risk if we want to grow our money

faster than the annual increase in our cost of living (inflation). I commend

you for thinking beyond the GIC (which is pretty close to

"risk-free"), which, if it earns 1%, is going to come up short

relative to the 2% average annual inflation rate. Remember, your inflation rate

may differ somewhat from the Stats Can average based on where you consume and

what you consume (and the costs associated with your consumption of goods and

services).

3) We are in somewhat unprecedented times. Economies are

seriously depressed at the moment and the uncertainty going forward is

enormous. Some more optimistic folks (economists, investors, politicians)

believe that this will all bounce back rather quickly (a "V" shaped

recovery). Personally, I tend to side with the critical thinker crowd and

believe it is going to be more of a "W" shaped recovery. Some pretty

smart people actually think it may be more of an "L" shaped recovery

and we might experience a decade of low growth.

4) Consider that it is going to take a long time for

consumers to be comfortable just leaving their homes just to buy basic

supplies, let alone travel or dine out or be entertained (theatre, sports,

etc.). That is going to continue to be a huge economic hit. Jobs lost in the

hospitality sector are likely not coming back in a hurry. Household incomes could take be jeopardized after all the government sponsored programs dry up. Consumers would certainly be

spending less. A vaccine discovery might ease this situation, but it will take

time and in the interim there will be much damage done to the economy. There is an enormous

amount of household, corporate and government debt out there: how will that

debt get repaid if consumers and businesses are functioning at reduced

capacity, which is highly likely? Financial services (banks and insurance companies) could take a big

take a hit, I would say that could put pressure on their dividends. My business partner, Paul, who does the bottom-up research on the companies that we (High Rock) monitor suggests that banks are racking up provisions for credit losses, which will likely turn into "Gross Impaired Loans". If capital falls, they will be forced to raise equity (share issuance) or cut dividends (as did Wells Fargo). Share buybacks (which helped drive prices higher through to 2019) have also been curtailed. Paul says that BMO is very extended in the energy space and received a poor rating from the Fed last week. It would not surprise him to see a dividend cut.

5) Given all the uncertainty, my question to any investor is

how much risk are you comfortable taking? Try reading this on Suncor : https://www.fool.ca/2020/06/11/suncor-energy-tsxsu-stock-0-or-40/ for example. Suncor has already cut its dividend.

6) The portfolio that we manage for you is very broadly

diversified, by owning 6 equity index ETF's that cover the global range and own

thousands of various companies through many sectors. Owning individual

companies in only 2 sectors increases the risk (but also the potential return),

but you have to weigh that out against your long-term goals. The thing about

diversity is that if a company is forced to cut its dividend, it will have its

stock punished by investors (see MFC in 2007-09)

(It never recovered), but if you own many companies in a

relatively small and diversified way, the impact is diminished significantly.

If it was 1/3 of your investment, that would be a big hit and very difficult to

recover from. About Manulife now, Paul says : "

7) The portfolio that we manage for you now is positive by about 1% so far in

2020 (at the half way point), despite most stock markets being negative (you also own the Nasdaq index ETF, QQQ, which is positive). That is also a

result of owning a portion of your portfolio in bonds (balance) which are the best

performing asset class this year (even though they may pay minimal interest, they

are a safe haven in times of economic stress).

8) So once again, back to you to determine how much risk you

are willing to take with your savings. With economic growth likely not going to

get back to 2019 levels until 2022 or 2023, it is difficult to see corporate

earnings (upon which companies are paying dividends or retaining them for

re-investment and growth), with much upside potential (other than pure

speculation, which is gambling and not investing).

9) My recommendation, at least for the time being, would be

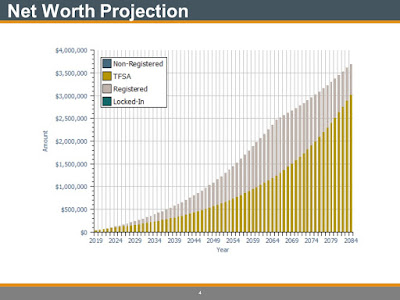

to invest your hard-earned savings in your balanced and diversified portfolio ( as my good friend Tony Chapman calls it: "flattening the curve") with High Rock and let us professionals (lots of experience, education, insight and

fiduciary duty) help you build and steward your wealth in our risk-adjusted

manner. We are wealth and portfolio managers, not investment advisors. There is a big difference.

10) There is a tendency among some market participants to

want to try to “get rich quick” and so they start day trading, it is certainly

a fad now (it was in 2000-02 as well). This never ends well, for the

majority: https://www.msn.com/en-us/money/topstocks/barstool-sports-dave-portnoy-is-leading-an-army-of-day-traders/ar-BB15oo0r.

11) As always, it is your money and as a young adult,

ultimately your decision as to what direction you take, but I would suggest

that you focus on your strengths and build your career around that. If you find

that you want to become an investing professional, let me know, High Rock is

always looking for good, sharp, young minds. In the end, it is about making a

plan and sticking to the plan and reaching whatever goals that you set out for

yourself.

Happy, as always, to discuss any of this in more detail if

you wish!

Be safe, stay healthy!